nj payroll tax calculator 2020

It simply refers to the Medicare and Social Security taxes employees and employers have to pay. Post-Retirement Contributions to a Section 403 b Plan.

Paycheck Calculator Take Home Pay Calculator

Federal income taxes are also withheld from each of your paychecks.

. Choose a Login Path. North Dakota Paycheck Calculator. For employers for 2021 the wage.

For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000. 2020 Base week amount. How to calculate annual income.

If your monthly paycheck is 6000 372 goes to Social Security and 87 goes to Medicare leaving you with 6000 372 87 5541. The US Salary Calculator considers all deductions including Marital Status Marginal Tax rate and percentages income tax calculations and thresholds incremental allowances for dependants age and disabilities Medicare Social Security and other payroll calculations. 2020 Alternative earnings test amount for UI and TDI.

The New Jersey Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and New Jersey State Income Tax Rates and Thresholds in 2022. Federal Filing Status of Federal Allowances. 2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers.

Flexible hourly monthly or annual pay rates bonus or other earning items. In New Jersey unemployment taxes are a team effort. If youre a new employer youll pay a flat rate of 28.

Employer Requirement to Notify Employees of Earned Income Tax Credit. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks. As the employer you must also match your employees.

Certain amounts of these taxes are the responsibility of the employee and others are paid by the employer. This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Choose Marital Status Single or Dual Income Married Married one income Head of Household.

What does eSmart Paychecks FREE Payroll Calculator do. FUTAs maximum taxable earnings whats called a wage base is 7000 anything an employee earns beyond that amount isnt taxed. Free for personal use.

We also have a free 401k planner and W4 helper. Rates range from 05 to 58 on the first 39800 for 2022. The withholding tax rates for 2020 reflect graduated rates from 15 to 118.

The tax rate is 6 of the first 7000 of taxable income an employee earns annually. Paycheck amounts payroll tax and tip taxes. Your employer uses the information that you provided on your W-4 form to determine how much to withhold in federal income tax each pay period.

There are seven tax brackets for those single or married and filing separately and eight tax brackets for. New Jersey paycheck calculator. 2020 Taxable Wage Base TDI FLI workers only.

New Jersey Paycheck Calculator. Number of Allowances State W4 Pre-tax Deductions 401k IRA etc. File and Pay Employer Payroll Taxes Including 1099 1095 Electronic Filing Mandate.

How Your New Jersey Paycheck Works. New Jersey Gross Income Tax. Unemployment Insurance UI.

Withhold 62 of each employees taxable wages until they earn gross pay of 142800 in a given calendar year. Median household income in 2020 was 67340. HR Help Center Login.

The maximum an employee will pay in 2021 is 885360. New Mexico Paycheck Calculator. New employers pay 05.

Number of Qualifying Children under Age 17. PANJ Reciprocal Income Tax Agreement. New Yorks income tax rates range from 4 to 882.

To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. It is not a substitute for the. In this post well delve into what payroll taxes are what the rates are for 2019 changes for 2020 how to calculate payroll taxes where the money goes and who pays what.

Both employers and employees contribute. Work out your adjusted gross income Total annual income Adjustments Adjusted gross income. North Carolina Paycheck Calculator.

Federal Filing Status of Federal Allowances. States dont impose their own income tax for tax year 2022. FREE Paycheck and Tax Calculators.

The US Salary Calculator is updated for 202223. After a few seconds you will be provided with a full breakdown of the tax you are paying. Figure out your filing status.

Commuter Transportation Benefit Limits. The New Jersey State Tax Tables for 2020 displayed on this page are provided in support of the 2020 US Tax Calculator and the dedicated 2020 New Jersey State Tax CalculatorWe also. The rates vary depending on income level and filing status.

Taxes Paid Filed - 100 Guarantee. The 118 tax rate applies to individuals with taxable income over 5000000. New York Paycheck Calculator.

How Your New Jersey Paycheck Works. Check if you have multiple jobs. New Jersey has a progressive income tax system ranging from 140 to 1075 that is structured similarly to the federal income tax system.

Our free payroll calculators can help you calculate. 2020 Maximum Temporary Disability Insurance weekly benefit rate from July 1 December 31. So the tax year 2021 will start from July 01 2020 to June 30 2021.

Calculating your New Jersey state income tax is similar to the steps we listed on our Federal paycheck calculator. Helpful Paycheck Calculator Info. For example in the tax year 2020 Social Security tax is 62 for employee and 145 for Medicare tax.

The top tax rate is one of the highest in the country though only individual taxpayers whose taxable income exceeds 1077550 pay that rateFor heads of household the threshold is 1616450 and for married people filing jointly it is 2155350. Details of the personal income tax rates used in the 2022 New Jersey State Calculator are published below the. 2020 Taxable Wage Base UI and WFSWF - workers and employers TDI employers.

To use our New Jersey Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. Ad Payroll So Easy You Can Set It Up Run It Yourself. Several factors - like your marital status salary and additional tax withholdings - play a role in how much is taken out from your.

Rates range from 04-54 on the first. Free for personal use. Computes federal and state tax withholding for paychecks.

Free Business Sales Tax Calculator Calculate Your Tax Now With Clickfunnels

Payroll Tax What It Is How To Calculate It Bench Accounting

Excel Formula Income Tax Bracket Calculation Exceljet

What Are Marriage Penalties And Bonuses Tax Policy Center

Different Types Of Payroll Deductions Gusto

Payroll Calculator Free Employee Payroll Template For Excel

10 Tax Breaks When You Own A Home Infographic If You Re Searching For Information On Tax Benefits Of Owning A Home You Real Estate Buying First Home Estates

How To Calculate Your Overtime Tax Gocardless

New Jersey Income Tax Calculator Smartasset Income Tax Income Tax Return Federal Income Tax

Chapter 1 Excel Part Ii How To Calculate Corporate Tax Youtube

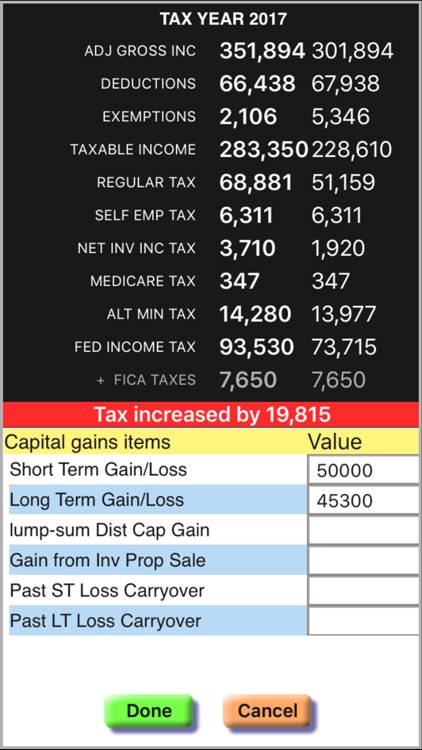

Income Tax Calculator Taxmode By Sawhney Systems

Payroll Calculator Free Employee Payroll Template For Excel

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Paycheck Calculator Take Home Pay Calculator

Excel Formula Basic Tax Rate Calculation With Vlookup Exceljet

Nanny Tax Payroll Calculator Gtm Payroll Services

Payroll Calculator Free Employee Payroll Template For Excel

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate